Section 45L Tax Credit - Past, Present, and Future

45L Introduction and History

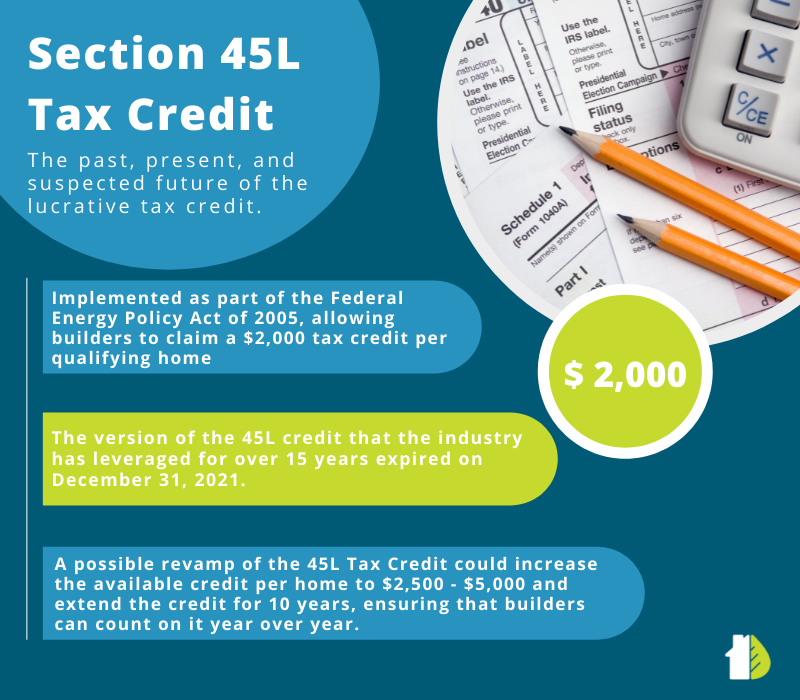

The 45L Tax Credit dates all the way back to Jan 1, 2006, when it was implemented as part of the Federal Energy Policy Act of 2005. Since its inception, it has allowed builders to claim a $2,000 tax credit per qualifying home.

The calculation procedure to determine if a home qualifies is quite complex and described by RESNET Publication 001. However, in simple terms, the home must be simulated using a software tool like Ekotrope to show heating and cooling consumption that is 50% of the IECC 2006 Reference Home or lower, with at least ⅕ of that energy savings coming from building envelope improvements. While the IRS does not publish the number of homes that claim this credit each year, we are reasonably confident that the number of claimed homes has increased over time as energy codes have become more stringent and builders have prioritized increasing capture rates. In 2021, some large national builders claimed over $50 million in 45L Tax Credits. The most common way to capture this credit is to work with a HERS Rater to design and inspect the home’s energy features to prove compliance. You can find more details about the credit here.

Ekotrope software is one of five software tools approved by the DOE for 45L Tax Credit compliance calculations.

45L Present

The version of the 45L credit that the industry has leveraged for over 15 years expired on December 31, 2021. Thus, there is currently no active 45L Tax Credit for homes built and sold in 2022. However, it is likely that some version of the 45L Tax Credit will be revived and will go into effect retroactively, allowing builders to claim the credit for all 2022 homes. Also - builders may still claim the tax credit retroactively for homes built and sold in 2019 - 2021.

45L Future

The 45L Tax Credit is generally bipartisan and widely embraced, and our team feels that it is highly likely to be reinstated in some form. There are generally two ways this could happen:

Option 1: The Democratic budget reconciliation package formerly known as the Build Back Better plan includes a revamp to the 45L Tax Credit. This new 45L Tax Credit is a great improvement for several reasons:

It increases the available credit per home to $2,500 or $5,000.

It updates the calculation procedure to be based on well defined DOE energy standards, which ensures that the DOE can enforce quality assurance standards and proper inspection protocols.

It is based on whole home performance rather than only heating and cooling efficiency. This means that components like water heaters, lighting, appliances, etc. can now contribute to compliance.

It extends the credit for 10 years, ensuring that builders can count on it year over year as they improve their design specifications to become more energy efficient.

Single family homes would be eligible for $2,500 if they meet ENERGY STAR 3.1 requirements or $5,000 if they meet DOE Zero Energy Ready requirements, while multi-family homes would typically be eligible for $500 if they meet ENERGY STAR 3.1 or $1,000 if they meet DOE Zero Energy Ready. Alternatively, multi-family homes would be eligible for the single family tax credit levels ($2,500 or $5,000) if all laborers and mechanics employed in the construction of the homes were paid at or above the prevailing wage for similar construction in that locality.

Option 2: If the Democratic reconciliation package does not pass, or if the 45L Tax Credit somehow gets stripped out (which we believe is extremely unlikely), there is still an opportunity for the previous version of the tax credit to be reinstated via a tax extenders package at the end of the year.

Based on everything we have heard from our representatives in Washington D.C., the most likely outcome is that a reconciliation package with the new, improved 45L Tax Credit will pass this Summer and will be implemented retroactively for 2022 homes. However, politics are highly unpredictable, so stay tuned for updates! You can subscribe to our newsletter or keep an eye on our website.